Happy New Financial Year everyone and thanks for visiting ArtSHINE’s blog.

Your support means a lot to us at ArtSHINE.

The starting of a new financial year is very exciting for you and maybe for others, a little nervous, little lost and may even lack focus and purpose.

For us at ArtSHINE there’s surely a psychological New Financial Year effect that gives us the excitement and motivation to work towards our new financial year goals for 2014/2015.

So, have you set Your New Financial Year’s Business Goals yet?

If you did not get the chance, you still have time. Setting new purpose goals don’t have to wait for the new year or a special event. In fact you can set new goals at any time, there is no such thing as it being too late to set new goals either!

So do it now! You have not missed the boat at all. You might feel like you did. It’s all in your head, just because the new financial year has started already, that does not mean that you are late for setting your goals.

However, New Financial Year is definitely a great time to set new business goals. The New Financial Year is a new beginning and you too can start the New Financial Year with a clean slate.

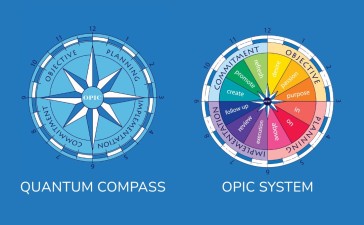

If you don’t know where to start and not sure how to set your business goals that are focused,we’re here to give you some helpful tips so you can get start it.

Setting business goals is not hard to do, the hardest things are to execute those goals so you can get where you want to be. This is where the majority of business owners fail to take action. Poor execution will delay and even stop you achieving your financial business goals.

Here’s what you need to do first. Take some quality time to review the following:

- Your business plan

- Profit and loss statement

- Cash flow projections

- Banking and accounting systems.

These areas of your business are imperative and a lot of times business owners seem to overlook them.

Now is the right time to do a business health check.

Here are six tips to ensure you start the new financial year on the front foot.

1. Booking Keeping management in good order.

Ensure your records are in order all year round. This habit is hard for lots of people to adopt but it’s critical to have. To make life even easier for everyone, There are many accounting software packages available to suit your business needs. You can use MYOB, or the online accounting Xero. We really like Xero as it gives you much greater visibility of your cash flow and it’s fast and easy to reconcile your bank transactions. Having the right book keeping software will keep your business on the right financial path. It will make thing easy to keep your record up to date.

2. Review your last financial year performance.

Refer to our last post ‘Is your business ready for end of Financial Year‘. It is important to take some time before the new financial year to track your progress in the last 12 months. Define the following areas of your business:

- Have you achieved your financial goals?

- Have you met your business goals in sales, services, products, web traffic and social media traction? If not, why?

3. Set performance goals for the new financial year.

To have a great successful business you need constant reviewing, testing and measuring as regularly as you can. Once you knew how you performed the previous year you can then set new goals for the coming year.

Setting budgets is an essential part of business planning for the new financial year. Having budgets set in place ensure that all aspects of the business are working well together. The budgets are the platforms that guide you to success, they give you clear measurable goals for you to work towards during the next 12 months. Here ‘s the good news, A well define plan will enable you to review your budgets and evaluate your business progress, It will also give you the device to identify any potential problems that may arise and opportunities to boost your business.

4. Seek professional advise in how to maximise your Tax Return.

Things you can do before the end of the tax year on June 30 to maximise your tax return, including pre-paying some expenses and deferring some incomes. Again, we encourage you to seek appropriate professional advise from your accountant or financial advisor. They are the right personnels to assist you with this matter.

5. Diarise Tax purpose key dates.

Be familiarised with all lodgement dates that must be met at tax time. For example your team members’ group certificates now is known as ‘Pay As You Go payment summaries must be issued to your staff by 14th July. Your Super payments for June quarter must be paid by 30th June and many more.

6. Update or write your business plan.

A good business plan is a like a road map, it can help you foresee your business from now to the future. Here you can set short, middle and long term business goals. A business plan can help you identify why you start your business in the first place, who you are, your vision, mission, culture, your ideal target markets are, and can also help you define your SWOT (strengths, weaknesses, opportunities and threats) that could potential emerge in the near future.

If you prepare well, plan well and execute well you will achieve your financial goals.

So good luck and we wish you all the best and success for the New Financial Year 2014/ 2015