Last week we talked about Cash Flow Really Is King in your business.

Today we want to give you some tips in how to do a cash flow projection for you business. It doesn’t matter if you are a new start up or an existing business. If you haven’t got one, now it’s the right time to set one up. In fact, It’s a perfect time to do one, as the new financial year will commencing on the First of July (in Australia). What a great way to start off the new financial year with a clean slate.

Whether you are a new or existing business, an accurate financial forecasting is vital to your business. A cash flow projection will give you an idea of what to expect each year and will even drive you to reach your business goals sooner.

Keep in mind, The forecast should all be realistic. A lot of young creativepreneur focus too much on profits too soon, when your attention should in fact be on cash flow, and budget control. When you have your finances in control, you’ll ensure that your business won’t run into the financial problem because of over spending and not enough sales coming in to support the business.

There are two key elements that play a major part in “Working On” your business:

- Marketing/ Promotion strategy

- Cash Flow Projection

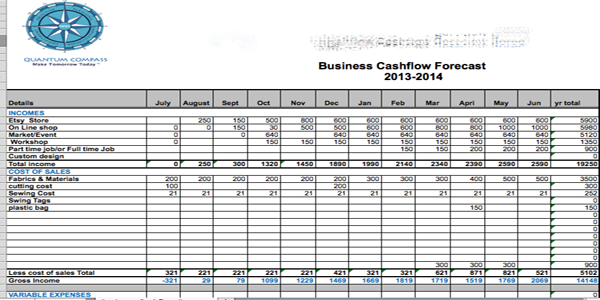

Today we talk about Cash flow projection. Here is what you need to do:

- Start with the cash on hand figure – your current bank account balance(s) plus actual cash and coin.

- Make a list of expected Money coming in (inflows) – sales payments, collection on bad debts, interest or investment earnings, etc. List not only the amount, but also when it will be hitting your bank account.

- Make another list of expected but this time is for Money going out (outflows) – wages, monthly overhead, payments on accounts payable or other debt, taxes payable or set aside for future payment, equipment purchases, marketing expenses, insurance etc.

Create an excel spreadsheet and put it all in chronological order. Once yo have your cash flow projected for the next 12 months you will have a clear picture of what to expect each month. The forecast also will help you define the following:

- Your incomes & expenses you would like to see in the next 12 months.

- It will clearly tell you where the gaps will be, the short-fall or the surplus of each month.

If at any stage you have negative cash balance on a particular month, you have a potential problem. To prevent future shortfall, it would be a good idea to come up with marketing strategy and promotional campaign to increase sales. Sales will give you income and will lift a negative to a positive cash flow, this is where you want to be at all times. There are lots of business owners the first thing they would do is to cut cost and this is a very common approach to do and it sounds logical but you can only cut so much cost. However, an active business owner on the other hand would identify the negative cash flow and actively come up with sales & marketing strategies to increase sales. Therefore you can fulfil the gaps and pick up the shortfall, this is the approach we would encourage you to take.

The cash flow projection is like a snapshot of your business and you can use it to manage your business in a regular basis. What work well for our clients is they can track their cash flow in a monthly and quarterly basis, which help them identify any potential shortfall arises in the coming months. By working on a quarterly basis will give you time to come up with solutions to lift those negative to a positive cash balance. Remember everything takes time and you’ll need to allow at least 30-90 days for your business to turn around. Please do not wait until the last minute and expect miracle to happen.

It’s also best to be extremely conservative when projecting your cash flow. Always estimate your inflows (Money coning in) lower then actual and outflows (Money going out) little higher. If you end up with a cash surplus, which is a great news to have, it can cover for an unanticipated cash shortage in the future, or be invested in something to help grow your business. Really you won’t have any problem finding something useful to do with the extra funds. On the other hand, if you end up with an unanticipated cash shortfall, you can end up damaging your credit rating, losing suppliers, having to reduce staff, or force closure to your business.

Would you like to learn how to keep track of your actuals versus your projected cash flow?

Tune in for next week, we will share with you tips on how effectively tracking your actual cash flow and use the data to make inform decision to keep your cash-flow in control.